Upon the receipt of the money you have paid, your challan status should change into “paid”, but there may be cases when this does not happen. The receiving bank should upload the payment details in the Challan to Government, through the Online Tax Accounting System (OLTAS) of the National Securities Repository Limited (NSDL) within the three working days following your payment.

Why verifying a paid challan status is necessary

To make sure that everything is in order with your payment, you have to cross-verify that both the Challan Identification Number (CIN) and the amount you paid were correctly uploaded by the bank to NSDL.

This will give you peace of mind and will exempt you from any further unpleasant consequences. For instance, not paying a pending traffic challan in due time would expose you to the police opening a charge-sheet on you as a vehicle owner.

What you need to verify your paid challan status

When you decide to verify the status of a paid challan, you can do it with either with its CIN provided by the bank or with its Tax Deduction Account Number (TAN). Let us consider the case of one of the following:

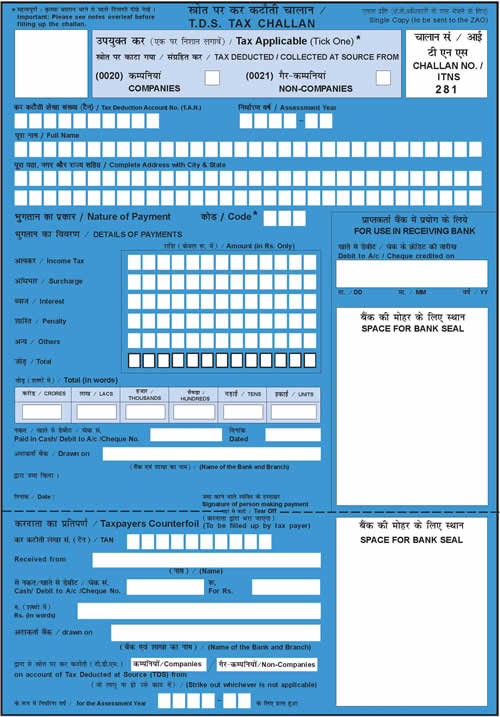

- Challan 280, which is the challan for income tax on companies or other entities;

- Challan 281, which is the challan for taxes deducted or collected at source from companies or other entities.

To verify the status of your paid challan, you can use the CIN, which has three parts:

- A seven digit code identifying the bank branch where your tax is deposited;

- A six digit code representing the date of the tax deposit, under the form ddmmyy;

- The serial number of the challan.

According to the order issued by the Reserve Bank of India, all the banks must use a rubber stamp to acknowledge the payment, which includes the CIN. If your challan does not contain a CIN, contact the respective bank immediately and insist on getting one. Should the bank not resolve the issue, address your grievance to the Regional Manager of the bank and the Regional Office of the Reserve Bank of India.

How to technically check the status

To check the status of your paid challan, follow these steps:

- Go to the NSDL website and select “Challan Status Enquiry”.

- Select either CIN base view or TAN based view. The system should return a set of data, depending on the option you have chosen.

- If you get the details, you can rest assured that the payment has been recorded and your debt has been cleared.

If three working days have passed and you still do not see the details of your challan, do not hesitate to contact the bank branch where you made the payment and have them check. Under no circumstances should you put off taking measures if, upon checking your pending challan status, you notice that the details of your payment are not present on the NSDL website, because this means that your payment has not been recorded correctly.